Usps Postage Went Up Again No Longer Worth Seing on Ebay

Published at Jun 16, 2016.

Last updated 8/19/2021.

What percentage does eBay have? Ordinarily 12.55% (non 10% like it used to). But that's simply 1 of the fees you'll face. What yous should really be asking is, what does it cost to sell on eBay?

There are tons of hidden costs involved in selling on eBay. If you don't know virtually them, you could lose money on items you thought would turn a turn a profit.

Nosotros provide a quick explanation of the costs in "Selling on eBay for Beginners: five Steps to Success." That'south a proficient place to learn the basics of how the fees are calculated. This article, though, is for those who want to get deeper.

Concluding Value Fees (eBay'south Percent of Every Sale)

Short version: eBay takes a pct of well-nigh all sales, ranging from 1.5% to 15%.

eBay's concluding value fees are oft the largest single cost for sellers. They're taken every bit a percentage of the amount actually charged to the customer. That includes the item price, the aircraft toll,and any sales tax. (I small-scale break: If the buyer chooses international or1-mean solar day shipping, you lot're charged as if the shipping price was your cheapest domestic choice.)

The percentage depends starting time on whether you employ managed payments. This is the default for new sellers, and all other sellers will exist required to switch to managed payments by the end of 2021. You can find the final value fees for managed payments sellers hither and for non-managed here.

Next, it depends on the category y'all're selling in and whether you have an eBay Store. Following is a quick overview of what you might take to pay on each sale. If you know what you want to sell, take notes—we'll get to calculating your total fees later on.

With no Store or a Starter Store (managed paymentsin bold/not managed in italics / same for both in standard text):

- 15% /12.85%on watches.

- 14.55% / 12.2% on books, magazines, movies, Television, and most music.

- 12.55% /10.ii% for well-nigh listings.

- 12.35% on bullion and on trading/collectible cards.

- 5.85% /3.5% on guitars and basses.

- 5% on NFTs.

- iii% /2% on some Business & Industrial categories.

- 0% on able-bodied shoes with a starting price of at least $100.

Note that on managed payments, well-nigh categories have tiered pricing structures. For instance, if y'all sell an item worth more than $7,500, the fees ofttimes drib to ii.55%. On non-managed payments, at that place are usually fee limits instead, generally $750 as the max fee.

With a Bones or Premium Store (managed payments /not managed):

- Thresholds for lower fees on high-value items reduced, usually from item values of $7,500 to $2,500. /Maximum final value fee of $350 on most categories, with a $250 maximum on Guitars & Basses and some Business & Industrial categories.

- 14.55% /12.ii% on books, magazines, movies, TV, and most music.

- 12.5%/10.35%on watches.

- xi.7% / 9.35% for most categories.

- 11.5% on collectible/trading cards.

- x.7%/8.35% for eBay Motors Automotive Tools & Supplies categories and virtually eBay Motors Parts & Accessories categories.

- ix.v% /7.35% for most Musical Instruments & Gear categories.

- 8.7% / 6.35% for most Cameras & Photo categories, well-nigh cell phones and retentivity cards, most Computers/Tablets & Networking categories, near consumer electronics, stamps, and virtually Video Games & Consoles categories (but Not video games orconsoles).

- eight.5% /half-dozen.35% for DJ and pro sound equipment and for paper money and coins.

- 7% on bullion.

- 6.55% / four.two% on video game consoles and most major calculating devices like computers, tablets, and printers and many of their components.

- 5.85%/three.5% on guitars and basses.

- 5% on NFTs.

- two.v% /1.v% on some Business & Industrial categories, like heavy equipment.

- 0% on able-bodied shoes with a starting price of at least $100.

With an Anchor or Enterprise Store:

- Maximum terminal value fee of $250 on all categories (non-managed payments sellers merely).

- Otherwise, the same as Basic and Premium stores.

The final value fee discounts tin can brand a Store pretty tempting, and they will often save you a lot of money. Just brand sure yous know exactly when an eBay Store is worth the cost before shelling out your difficult-earned money.

If you're selling cars on eBay, note that vehicles take their own special fees rather than final value fees. Another list types, like real estate, likewise take unique fee structures.

Client Service Affects Final Value Fees

If you lot offer a great client feel, you can become a Meridian Rated Seller and get 10% off your final value fees. (Eastward.g., if you commonly paid 12.55%, you'd pay 11.295% instead.)

But eBay knows people are merely motivated then far by carrots. They likewise accept a stick: if you driblet below their seller performance standards, you'll become an extra 5% slapped on superlative of your terminal value fees (whether or not yous use managed payments). They'll besides nail you with the extra 5% in categories where your rate of "Detail not as described" claims reaches "Very High," even if you're an higher up-standard seller.

Thankfully, these extra fees don't stack. Yous won't have to pay an actress ten% if both situations apply. But, the results are still actually bad.

If yous accept one of these penalties, that means that if you normally paid 12.55%, you'd pay 17.55% instead.

Manage eBay customer support from your favorite helpdesk.

Explore how to streamline eBay buyer messages, resolution center bug, proactive messaging, and more than.

Worse, this extra fee ignores caps and reduced-fee thresholds! That makes it equally bad regardless of whether yous use managed payments or sell high- or low-value items. Here'due south how information technology tin play out:

- Non-managed payments: If you sold something worth $x,000, your normal 10.2% would stop at $750 equally if it had only been worth $vii,353. However, the 5% penalty would exist charged on the whole thing for an actress $500 in avoidable fees.

- Managed payments: If you sold an antiquarian worth $x,000, y'all would normally pay 12.55% on the first $7,500, and then just two.35% on the final $2,500. Your full fee should be exactly $ane,000. But with the extra 5%, you lot'd pay $ane,500 instead!

Those are some high stakes! Take eBay customer service seriously, exist honest, and ship on time to keep your final value fees affordable.

Insertion Fees (eBay'southward Apartment Fees)

Curt version: If you list a lot of items, y'all may need to pay an extra $0.35 or and so for some of them.

Every eBay seller gets to list a number of items every month without paying insertion fees. For nearly categories, these are every bit follows:

- No eBay Store: 250 items (with managed payments) or 200 items (without).

- With a Store (managed /non managed/ both):

- Starter Store: 250 listings total between fixed-toll and qualifying auction listings.

- Basic Store: 1,000 fixed-price items, plus 10,000 boosted in select categories. / 350 fixed-price items. Plus, 250 qualifying auction listings.

- Premium Store: x,000 fixed-price items, plus l,000 boosted in select categories./1,000 fixed-price items. Plus, 500 qualifying auction listings.

- Anchor Store: 25,000 stock-still-cost items, plus 75,000 additional in select categories. /x,000 fixed-price items. Plus, ane,000 qualifying auction listings.

- Enterprise Shop: 100,000 stock-still-price items, plus 100,000 additional in select categories. / 100,000 fixed-price items. Plus, 2,500 qualifying auction listings.

Anything above those limits costs the following (these are the aforementioned with or without managed payments):

- No eBay Store: $0.35 per listing.

- With a Shop:

- Starter Store: $0.30 per listing.

- Basic Store: $0.25 per list.

- Premium Store: $0.fifteen per auction, $0.10 per fixed-price listing.

- Anchor Store: $0.10 per sale, $0.05 per fixed-price listing.

- Enterprise Store: $0.x per auction, $0.05 per fixed-toll listing.

At present, you might be wondering why you get so few gratuitous auctions. Don't sweat it. If your auction succeeds and the item sells, eBay will refund your insertion fee (as long as information technology isn't in an excluded category).

They'll also refund insertion fees on stock-still-priced listings if they sell and the buyer doesn't pay up.

For some categories (mainly big-picture stuff like real manor and vehicles), there are no free listings. Y'all are always required to pay an insertion fee. This fee can range to well over $100, and information technology's the aforementioned whether or not you lot apply managed payments or accept a Store.

Other eBay Fees

You tin opt in to listing upgrades (managed / non-managed) for set-in-stone prices or Promoted Listings for a percentage of the sale. These tin more than double the fees y'all pay, and so use them wisely!

Aircraft and Treatment

Short version: Decide how much yous'll accuse for aircraft, because this charge counts toward your final value fee.

Now you know what eBay's going to accuse y'all... sort of. eBay will besides accuse its final value fee on any shipping costs you lot accuse. You therefore demand to know how much shipping and treatment will cost so yous can get an authentic grasp of the fees you'll need to pay.

For those of you lot offering free shipping, knowing these costs is even more of import considering you need to factor them into every price.

Either way, you lot tin't really understand the toll of selling on eBay until y'all understand aircraft and handling. Read our guide to shipping and treatment costs to determine how much yours will run yous.

PayPal, Managed Payments, or Other Payment Processing

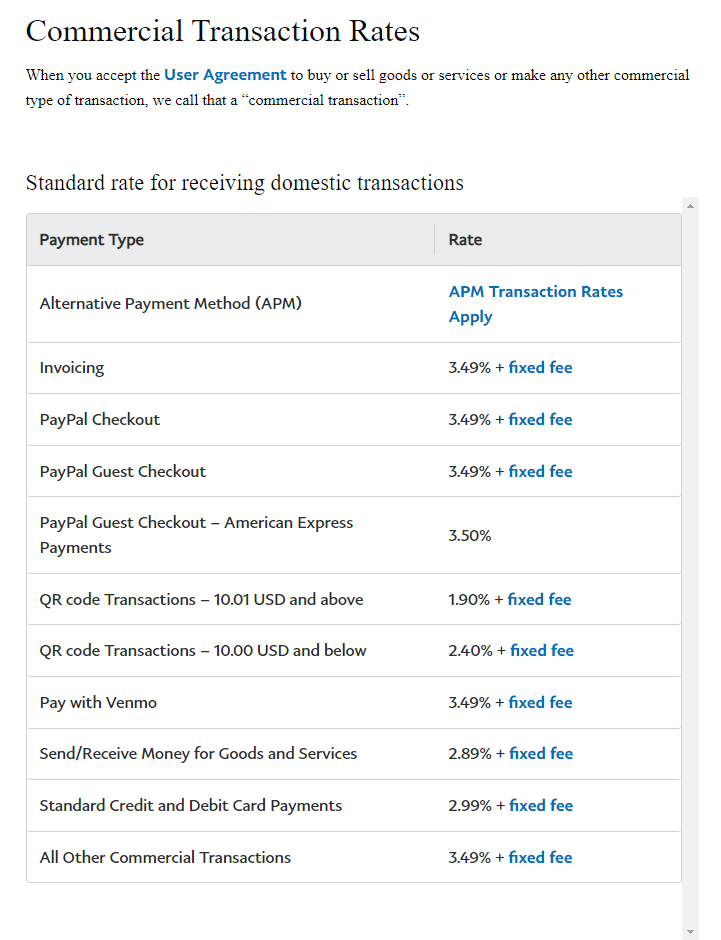

Below: 2021 PayPal fees.

Short version: Whether your payment processor is eBay, PayPal, or a credit carte du jour company, you can expect them to take a fixed fee and a percentage out of every transaction.

If you don't accept managed payments, your payment processor'southward fees should be a major consideration.

PayPal and other payment systems like credit cards all have to make money somehow—typically through complicated fee structures of their ain. These usually consist of both a per centum and a fixed fee per transaction. For example, PayPal fees for selling from one US location to another total 2.89% to iii.49%, plus $0.49 per transaction.

These fees are charged on the gross value of the transaction, before the concluding value fee and aircraft costs are taken out. It'south therefore important to consider your payment processing fees earlier setting your final price.

If you use eBay-managed payments instead of accepting payments through PayPal, cards, etc., you volition pay a higher final value fee than other sellers, every bit seen above. Yous volition also have to pay a fixed fee of $0.30 per society—noticeably lower than PayPal's $0.49. The per-society fee and the increment in final value fees are both there to cover the payment processing toll.

When you await at the deviation between eBay'south concluding value fees with and without managed payments, you lot tin can come across that it'southward usually 2.35% or less. This small-scale payment processing cost applies fifty-fifty if the customer pays through PayPal. The result is that it's ever cheaper to use managed payments than to use PayPal.

So, if you lot've been looking at the higher last value fees with managed payments and feel like you're getting ripped off, don't worry. eBay is really saving yous a ton of coin!

If you use managed payments, the only payment processing fee you accept to continue track of is eBay's $0.30 per-lodge fee. If yous use something else, similar PayPal, yous need to make a note of both the percentage fee and the per-order fee.

Notation: If yous have multiple payment methods, compare the different fee structures for each and try to determine how much you'll pay on average.

Sales Taxation

Short version: While the buyer pays sales tax, whatsoever sales tax amount can increase your final value fees.

As of 2021, eBay charges and remits sales taxation on behalf of sellers, at least in the US. Y'all no longer have to panic about getting every sales tax license in the country to sell!

Nonetheless, eBay doescount sales taxation in the full club value before applying their final value fee. So on sales where tax is practical, your last value fee volition go upward accordingly.

Sales tax varies by location. The United states of america average state + local sales tax at the time of this article'southward last update is 6.35%.

That may be a reasonable number to use in your calculations, but y'all may want to check your sales history to find a more authentic average for your business concern. Y'all may have much higher or lower taxes if your buyers are concentrated in specific states or cities. If you do, brand a note of your sales tax percent.

Advanced Final Value / Payment Processing Fee Adding

Short version: If you want your customers to cover the cost of selling on eBay, calculate the price you will accuse as "ten" using the post-obit organization of equations: x = p + z + (y*q), x + (10*due west) = q

Why Y'all Demand to Use Algebra

Then, you lot know the concluding value fee is going to price you 12.55% (or any happens to be the case). But you can't just become slapping an extra 12.55% on your prices and expect that to cover the fee.

You lot besides accept to account for the impact of sales tax on your final value fee. Simply you can't merely add an expected sales taxation to your corporeality and then calculate the final value fee on that, either.

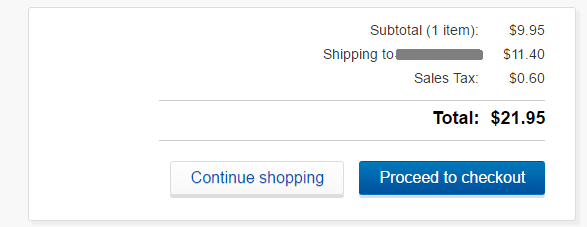

Say you programme to sell something for $forty. You add eBay'south $0.30 per order fee and become $40.30. Easy enough so far.

A 6.35% sales tax on $xl.30 would be $2.56, bringing the amount to $42.86. The 12.55% final value fee on $42.86 is $5.38. So you should add that fee amount to $40.xxx, right? $45.68 will get you $40 on an average sale?

Incorrect! The sales tax on $45.68 would be $2.xc, and the final value fee on that $47.58 total would come to $5.97. Subtract that and eBay's $0.30 per-order fee and you're left with $39.41—nonetheless $0.59 curt of your target of $40.

If y'all want to make sure that your price covers the final value fee and payment processing fee (both adjusted for sales taxation), plus any other expenses, you need to utilize algebra.

Edifice Your Organisation of Equations

Outset, add up all your stock-still fees for selling one of your items. First with any fixed payment processing fees. These include things like eBay's $0.30 or PayPal'south $0.49 per transaction.

Next, add together whatever other stock-still fees, such as insertion and/or listing fees if this is a unique item. (These fees will be spread out beyond numerous sales if you're using one listing to sell multiples of one production each month.)

The total value of all fixed fees higher up will be "z" in the formula below.

Adjacent, tally any percentages charged on the auction price. This would generally be your final value fee and possibly a payment processing fee.

- For managed payments users, this should only be your final value fee, unremarkably 12.55%.

- For most non-managed payments transactions, that means add PayPal's two.89% to 3.49% per centum to eBay's ten.ii% last value fee, for a total of xiii.09% to 13.69%.

Employ this per centum value as "y." To use a per centum in a adding, yous need to divide it by 100. So if you have 12.55%, you would utilize 0.1255 as "y."

Yous should too account for any sales taxation yous expect, using it as "westward." Notice your expected average sales taxation percentage and split information technology by 100. For example, if y'all expect an average sales tax of 6.35%, you should employ 0.0635 as "w."

Finally, determine how much you demand to receive from each transaction in club to encompass the costs of buying/manufacturing + aircraft and treatment the item while still making an acceptable profit. This value will be "p."

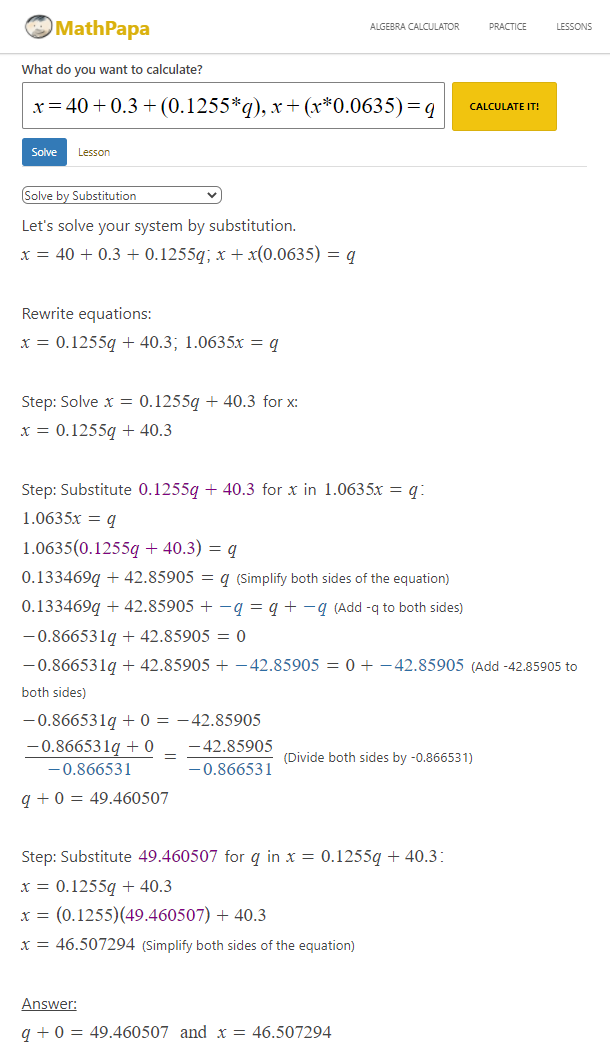

Now solve the system of equations below for "10" and "q." "Ten" will be the corporeality you need to set as your list price to get your minimum turn a profit, and "q" will be the amount the client is charged. You tin can solve this system easily by plugging it into an algebra figurer similar MathPapa'south.

x = p + z + (y*q), x + (10*w) = q

Example

Let's say I upload an item equally one of my free monthly listings. Since I apply managed payments, the only fixed fee I have to bargain with is the $0.30 eBay fee per transaction. Therefore, I enter 0.3 equally "z."

My concluding value fee is 12.55%. Since I'm on managed payments, I don't have to worry about a PayPal percentage fee, but otherwise I'd add that percentage here. I therefore enter 0.1255 as "y."

I decide to take the easy answer of 6.35% for sales taxation and enter 0.0635 as "w."

After adding up the toll of aircraft and handling and the cost of buying the particular I'grand reselling, I determine that I need to receive an boilerplate of $40 after fees in social club to embrace my expenses and make an acceptable profit. I enter 40 as "p."

So the equation I get is: 10 = 40 + 0.3 + (0.1255*q), x + (x*0.0635) = q. After running that through an algebra calculator and rounding, I get $46.51 equally "x" and $49.46 as "q." So, I need to charge $46.51 to get my desired profits, and charging that means my customer will pay $49.46 on average.

Proof Information technology Works

If I charge $46.51, a 6.35% tax on that would be $two.95.

2.95 + 46.51 = 49.46. So my charge plus the customer's revenue enhancement equals $49.46, just as the equation said. Good so far!

Now, eBay volition charge its final value fee of 12.55% on the final amount (taxation included) of $49.46. 12.55% of 49.46 is half-dozen.21.

The amount I've actually received from the client (tax not included) is $46.51. If I subtract that $6.21 fee, I get $40.30.

Finally, I remove eBay's $0.30 per-guild fee. That leaves me with a make clean, even $forty.

Using this formula will make sure y'all go exactly what you need out of every guild, without guessing or overcharging.

Decision: What Does Information technology Cost to Sell on eBay in Reality?

The real toll of selling a given item on eBay is fabricated up of the post-obit:

- The costs of making or buying the item you're selling.

- The costs of packaging, handling, and aircraft the item.

- Any fees you're paying eBay and/or your payment processor for the transaction.

These costs are in improver to your overhead: customer service, government let fees, paying freelancers to take photos or write descriptions for y'all, the opportunity cost involved in researching the item and dealing with suppliers, etc. Brand certain your margins are healthy enough to comprehend these expenses besides.

We knocked our ain costs way downwardly by integrating eBay with a helpdesk. We highly recommend it if you want to stay in the black!

Now that yous take your bookkeeping under control, you lot can focus on the more exciting aspects of running an eBay business organization. Start past figuring out what to sell on eBay. Then larn how to get a great eBay feedback score and then you can keep the sales coming in!

Source: https://www.channelreply.com/blog/view/cost-to-sell-on-ebay